Valuing chemical pollution, Oxbury Bank natural capital account, Lessons learn from BNG market, Intern spotlight

- eftec

- Sep 24, 2025

- 5 min read

In this Month's Newsletter:

The ENRICH Framework for valuing the environmental impacts of chemicals

Improving our understanding of the cost of chemical pollution in the UK through multidisciplinary collaboration

Oxbury Bank publishes their TCFD and TNFD aligned Natural Capital Account

Demonstrating how finance and natural capital can build resilience and long-term value

Lessons learned from the first year of the Biodiversity Net Gain Market

How effective is the market and how can it be improved?

Intern highlight

Celebrating our summer intern Tessa

The Call for Papers & Posters is out – Deadline for submissions: 1 December 2025

You can find more information, including the submission instructions, here.

The ENRICH Framework for valuing the environmental impacts of chemicals

Improving our understanding of the cost of chemical pollution in the UK through multidisciplinary collaboration

Thousands of chemicals are used across the UK, yet their impacts on nature remain poorly understood, measured, and valued.

To address this gap, eftec, in partnership with UKCEH and wca, developed the ENRICH (Environmental Risks and Impacts of Chemicals) framework, which provides a practical and flexible way to assess chemical pollution, bringing together insights from ecology, toxicology, and economics.

ENRICH will help connect chemical hazards and exposure data to ecological impacts and, ultimately, to the ecosystem services and economic values at risk. The framework was tested on different substances, refined with expert input, and supported by interactive look-up tools that can be updated as new data becomes available.

While some uncertainties remain, the framework highlights where key risks lie, identifies gaps in current evidence, and sets out clear priorities for future research. This structured approach allows for more systematic, evidence-based decision-making, even where information is incomplete.

Our Chemicals Policy Director Thea Marcelia Sletten presented this work at the 13th NerSRSAP meeting (earlier this month in Helsinki), organised by the European Chemicals Agency (ECHA).

The full report can be found via our website.

Oxbury Bank publishes their TCFD and TNFD aligned Natural Capital Account

Demonstrating how finance and natural capital can build resilience and long-term value

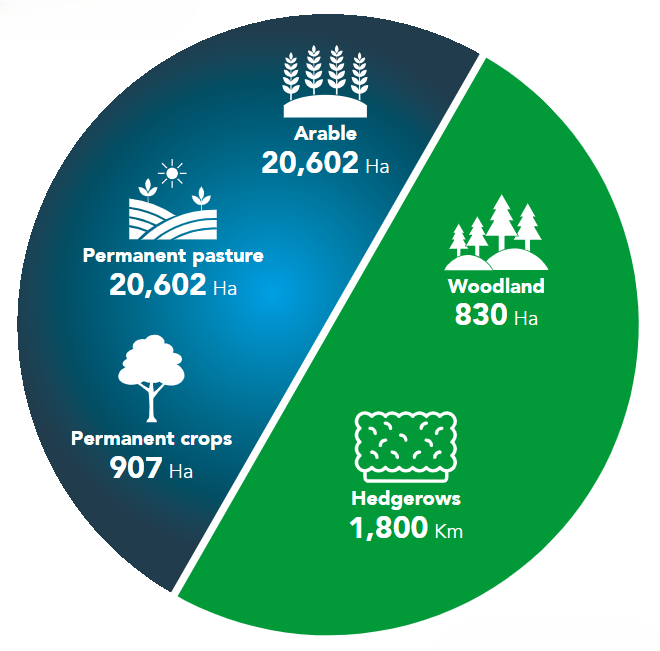

Oxbury Bank, the UK’s only specialist agricultural bank, recently published their 2024 Responsible Impact Report. In it, they present the work we did with Land App to construct a natural capital register and develop a method that will allow Oxbury to consider the value of natural capital. Further, this work was aligned to previous work Oxbury Bank had done to measure their impacts on nature using the LEAP approach to establish TCFD and TNFD reporting.

The study highlighted both the opportunities and challenges of integrating natural capital and biodiversity into decision-making. One of the main learnings was that farm-level indicators, such as the presence of wildflower or wild bird seed margins, are difficult to maintain at scale, as they rely on manual and regularly updated data collection from farmers.

The study also reinforced Oxbury’s view that soil should remain their primary biodiversity focus in the short to medium term, while they continue to explore new technologies that can deliver more scalable and comparable biodiversity metrics. Importantly, the natural capital valuation methodology we piloted, particularly regarding agricultural output, shows potential to inform future stress testing and risk management approaches.

Lessons learned from the first year of the Biodiversity Net Gain Market in England

How effective is the market and how can it be improved?

Over the summer, eftec was busy analysing the performance of the Biodiversity Net Gain (BNG) market in its first year. The analysis contributed to the responses from Lifescape Project and the Wildlife Trusts to Defra’s public consultation which closed in July.Our analysis used planning application data provided by The Planning Portal and interpreted the data based on our original BNG model for Defra and the expectations on how a well-functioning BNG market should work.

The first project focused on the treatment of ‘small sites’ in the first year of the BNG market. We found that:

86% of planning applications claimed they were exempt from BNG (far above the expected amount);

56% of all applications for exemption claimed a de minimis exemption, which applies when a planned development has an insignificant impact on any natural habitats; and

Around 30% of applications for large developments (over 1 hectare) claimed this de minimus exemption. This again is far above the credible proportion of applications that could claim this exemption.

In the second study, we explored what a well-functioning BNG market may look like and whether current and future (up to 2028) supply could meet demand (business-as-usual versus a ‘well-functioning’ market scenario). We concluded that:

In the Business As Usual (BAU) model, supply of Biodiversity Units is more than enough to meet demand nationally beyond 2026;

The potential future scarcity if demand for Biodiversity units increases is based on currently available supply data from only a portion of the market. If there is market confidence, future supply will likely enter the market to address this scarcity; and

The habitat creation and enhancement actions encouraged by the BNG requirement contributed £135 million in economic output and 1,300 jobs to the economy annually. This could increase to £250 million value and 2,450 full time jobs in a well-functioning market.

Our in-depth summaries for both projects can be found on our website.

Currently, we are investigating the role of the BNG market, amongst other nature markets, in meeting UK Government’s environmental goals. We look forward to sharing the results of this work soon.

Intern spotlight

Celebrating our summer intern Tessa

Every summer, eftec welcomes a cohort of interns. This year, Tessa Howarth-Jones joined the team, where she contributed to research for upcoming proposals, supported internal projects, helped gather and organise data, and assisted with aspects of company marketing.

Tessa said of her experience at eftec: “I really appreciated the collaborative environment at eftec and the opportunity to contribute to meaningful work. One of the most rewarding aspects was being involved in a variety of projects across different teams, which gave me a broader understanding of what eftec does, from natural capital accounting to the chemicals team […] Most of all, I’ve appreciated the people. I felt genuinely welcomed by everyone, whether it was a principal consultant or a researcher, and I always felt comfortable reaching out and speaking to anyone.”

We wish her the best for her future endeavours: Tessa will be completing her degree in Accounting and Economics at Oxford Brookes University in 2026. We are always open to hearing prospective applications for future internships. Interns are paid London Living Wage. Get in touch at [email protected]

Comments